Will You Still Be Able To Deduct Schedule E Losses In 2024

If you are looking for Can You Deduct Gambling Losses From Your Taxes? – geek4news you’ve visit to the right place. We have 15 Images about Can You Deduct Gambling Losses From Your Taxes? – geek4news like Can You Deduct Gambling Losses From Your Taxes? – geek4news, How Day Traders Can Deduct All Losses | 1215 Day Trading and also Can You Deduct House Insurance on Schedule A? | Finance – Zacks. Read more:

Can You Deduct Gambling Losses From Your Taxes? – Geek4news

Photo Credit by: geek4news3.blogspot.com gambling deduct losses

How Day Traders Can Deduct All Losses | 1215 Day Trading

Photo Credit by: www.1215daytrading.com losses deduct

Can You Deduct Your S Corporation Losses? Passive Activity Loss Rule

Photo Credit by: hbkcpa.com losses corporation deduct tax accounting

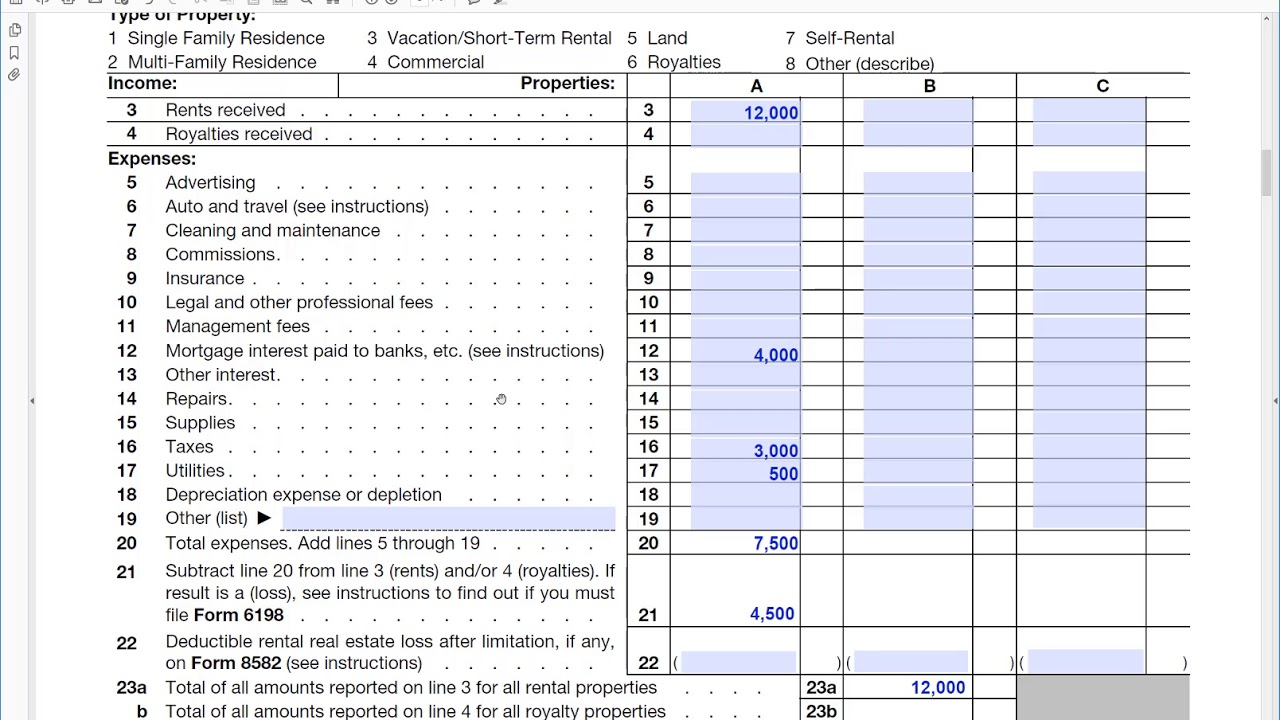

Tax Considerations For Real Estate Investors Mini Series: Can I Deduct

Photo Credit by: www.sikich.com

How To Deduct Stock Losses From Your Taxes | Bankrate

Photo Credit by: www.bankrate.com losses deduct bankrate taxes

Can You Still Deduct Business Use Of Home – Paul Johnson's Templates

Photo Credit by: indiana-mortgage76.blogspot.com offs deductions deduction deduct

Can You Still Deduct Ohio Income Taxes From Your Federal Taxes?

Photo Credit by: www.gudorftaxgroup.com taxes federal deduct income ohio

5 Expenses You Can Still Deduct In 2019

Photo Credit by: blog.eztaxreturn.com expenses deduct

Can You Deduct Your S Corporation Losses?

Photo Credit by: www.hbkcpa.com corporation 1120s form

Irs Form 1040 Schedule E – Schedule E Form Create Download For Free

Photo Credit by: svanopolis.blogspot.com irs 1040

To Deduct Business Losses, You May Have To Prove “material

Photo Credit by: www.theburnsfirm.com deduct losses prove

Can You Deduct House Insurance On Schedule A? | Finance – Zacks

Photo Credit by: finance.zacks.com deduct insurance schedule house deductions mortgage itemizing significant paid tax interest might money if

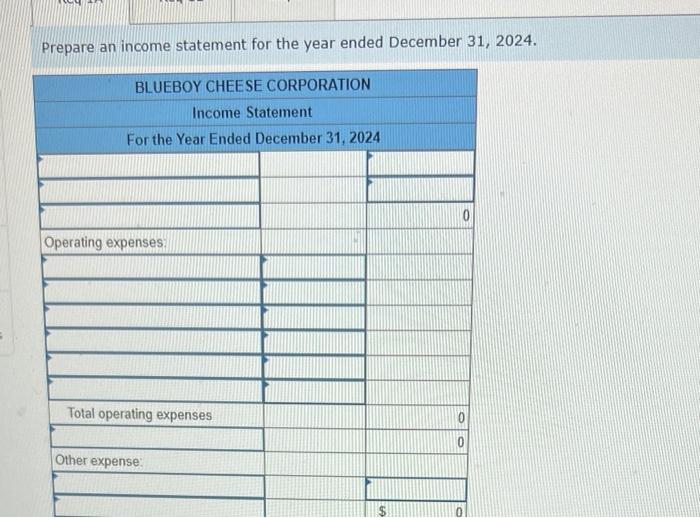

Solved The December 31,2024 , Adjusted Trial Balance For The | Chegg.com

Photo Credit by: www.chegg.com

20++ Unemployment Exclusion Worksheet – Worksheets Decoomo

Photo Credit by: worksheets.decoomo.com

How To Deduct Stock Losses From Your Tax Bill

/taxescoins-5bfc325146e0fb00514616ad.jpg)

Photo Credit by: www.investopedia.com beneficiaries losses fideicomiso nonprofit impuestos beneficiarios pagan deduct stocks organizations irrevocable investopedia

Will You Still Be Able To Deduct Schedule E Losses In 2024: Tax considerations for real estate investors mini series: can i deduct. Can you deduct house insurance on schedule a?. Offs deductions deduction deduct. Deduct losses prove. To deduct business losses, you may have to prove “material. How to deduct stock losses from your tax bill